📣 Message from Us

Welcome back. 👋 Each week we cut through the noise and explain what’s driving crypto. This past week had a lot of price action with some major news events in the banking and regulation space.

- Validator Digital

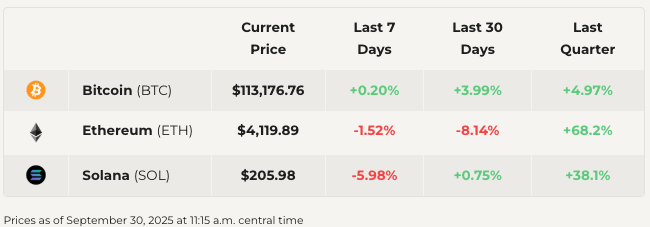

📈 This Week in Markets

The crypto market has recently rebounded, shaking off a significant downturn in September often called "Red September," where the total market cap briefly saw billions in losses. Over the past 10 days, Bitcoin has stabilized and traded mostly sideways (around $113,000 to $114,000), showing resilience after a drop from its earlier August high of ~$124,000.

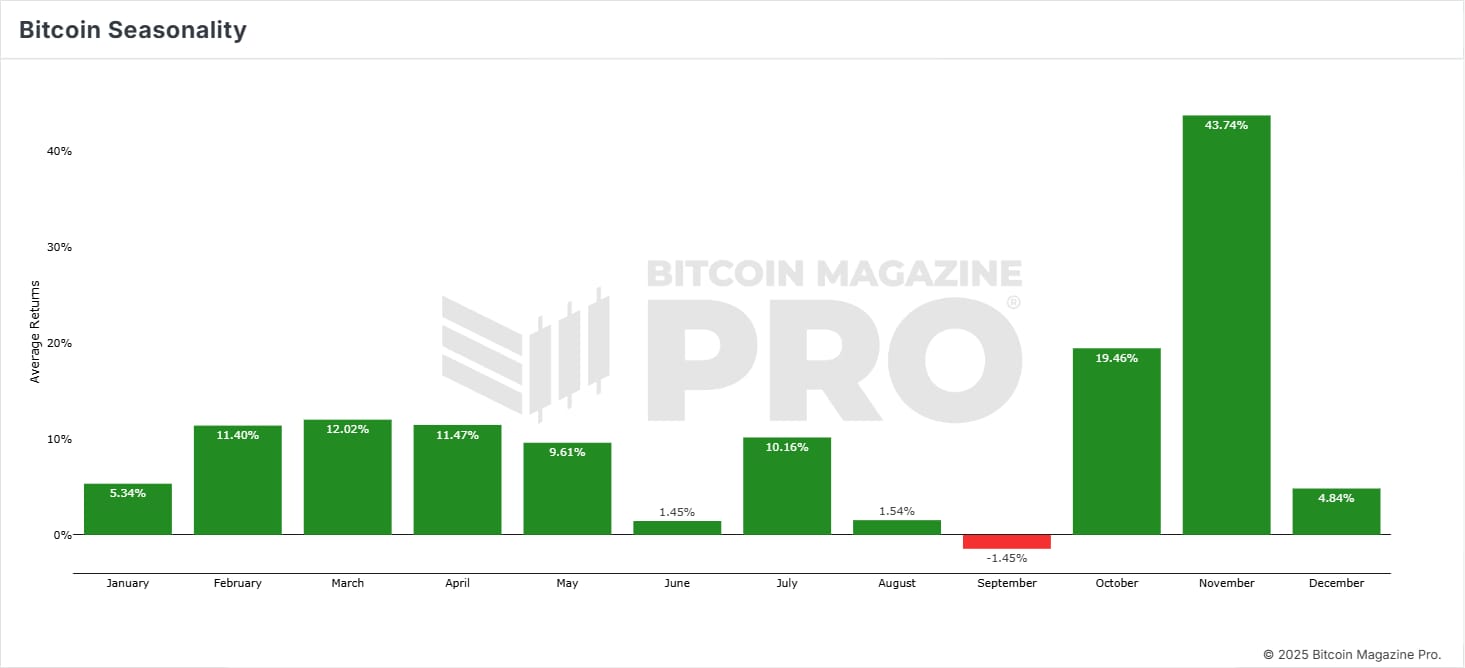

September stayed mostly on script. October and November are usually stronger.

Since 2010, September’s average return of -1.45% is Bitcoin’s weakest month, while October (19.5%) and November (43.7%) often post the best gains. With tailwinds from ETFs, payments rails, and positioning resets, this Autumn looks set to follow the historical norms.

🔦 Global Banking Network SWIFT Testing a Blockchain Upgrade

Society for Worldwide Interbank Financial Telecommunication (SWIFT), the cooperative that underpins most international bank transfers, just took a step into blockchain. For fifty years, it has been the secure messaging system banks use to tell each other who is sending money, where it is going, and how to settle it. SWIFT does not move money itself, but its reach is enormous: more than 11,500 connected institutions across over 220 countries and territories, handling tens of millions of payment and securities messages each day. When SWIFT upgrades, the financial world notices.

What set this up.

Banks have been experimenting with blockchain for years, but the hurdle has been interoperability. Each chain or token project can be siloed, making it hard for big institutions to plug in at scale. SWIFT’s new pilot aims to change that by creating a chain-based connection that lets banks interact with multiple blockchains through a single point of access. Instead of each bank building a custom link to Ethereum, Polygon, or others, SWIFT would be the universal adapter.

Who’s involved.

SWIFT is testing this pilot with more than 30 global banks. Big names include JPMorgan, HSBC, Deutsche Bank, MUFG, BNP Paribas, Santander, and OCBC. These are institutions that already move trillions across borders, so their participation is a sign the project is more than a lab experiment. The prototype itself is built in partnership with Consensys and uses Linea, an Ethereum Layer 2 network (🧩 101 Alert below: What is a Layer 2?).

How it works.

Think of SWIFT as a translator. A bank sends an instruction through SWIFT and the system converts it into the right format for the blockchain in use. The upgrade is being designed to run 24 hours a day, 7 days a week, which is a practical change from today’s model where settlement is tied to banking hours, time zones, and weekend closures. With always on rails, payments can clear while other regions are asleep, time zone friction falls, and corporates can sweep cash more often and free up working capital instead of waiting for the next business day. Cross border trades and tokenized assets can settle closer to real time, which lowers counterparty risk and shortens the time value of money. The aim is simple utility: faster settlement, fewer intermediaries, and more consistent liquidity across markets that feel fragmented today.

Why it matters.

Banks are getting more reasons to use blockchains, not fewer. Tokenized treasury bills and bonds are growing, stablecoins are settling more trades, and clients are asking for faster cross border payments and round the clock settlement. SWIFT’s upgrade does not force adoption, but it lowers the effort and risk for banks that want to try these use cases. If even a handful of large banks adopt SWIFT’s upgrade for clear wins, like faster settlement, fewer breaks, and simpler cash and collateral management, momentum can build quickly. For investors, that means blockchain adoption would be driven by utility in the financial system rather than hype, with real volumes and real assets moving across chains.

What this means for Ethereum.

This is another big pilot for the Ethereum ecosystem when it comes to the giants of finance. Earlier this month, NASDAQ filed a proposed rule change with the SEC to allow stock shares to live on an Ethereum based blockchain. While the war for the top financial blockchain is far from over, these are two promising developments for the Ethereum ecosystem.

🧩 Blockchain 101: What Is a Layer 2?

Imagine a crowded restaurant where every order must go through the head chef. Even a simple coffee waits behind a five-course meal. That’s Ethereum when all transactions compete on the main Ethereum chain (Layer 1).

A Layer 2 is like adding a skilled sous-chef with a well-run prep station. Most orders are prepared off to the side, then the finished plate and a short “ticket” get sent to the head chef for a quick check. The kitchen moves faster, costs drop, and the head chef still controls quality.

In practice, Layer 2s bundle many transactions and post a single summary to the main chain, along with proof that the work was done correctly. You get speed and lower fees, while the base blockchain remains the final source of truth.

Image Generated by Gemini

⏩ Quick Hits + 🔥 Hot Takes

SEC & CFTC hold joint crypto roundtable

No new rules, but both agencies publicly dismissed merger rumors and pledged to work together. The discussion focused on giving innovators clearer guardrails, sorting out how common crypto trading products should be handled, and smoothing capital rules that create inefficiencies. The upshot: better coordination should lower uncertainty and pave the way for cleaner, faster approvals in U.S. markets.Sending crypto on Paypal and Venmo is live

Users can now send Bitcoin, Ethereum, and PYUSD directly through PayPal and Venmo, whether to friends on the apps or to external wallets. With 438 million PayPal accounts and more than 80 million Venmo users, crypto transfers just became accessible to a huge mainstream audience.Vanguard reverses course on Bitcoin ETFs

After years of blocking access, Vanguard is reversing course and will let its brokerage clients buy third-party spot Bitcoin ETFs (per multiple reports; no formal Vanguard press release yet). With ~50M customers, this shift is one of the biggest endorsements yet of Bitcoin’s place in mainstream portfolios.SEC investigates insider trading around crypto treasury moves

The SEC and FINRA are probing unusual trading in companies whose shares jumped just before they announced crypto purchases for their balance sheets. If the probes uncover wrongdoing, regulators are likely to tighten disclosure rules for public companies that buy crypto. For long term investors, this could mean clearer information, less room for manipulation, and a healthier market backdrop.Bitcoin millionaires near 250K (record high)

On-chain data show nearly 250,000 BTC addresses now hold ≥$1M in bitcoin value, a new peak. Note this counts addresses, not people, but it’s a clear signal of wealth concentration and cycle strength. A larger base of high-value holders also tends to reduce volatility by anchoring demand.

Image generated by Gemini

📈 Chart of the Week

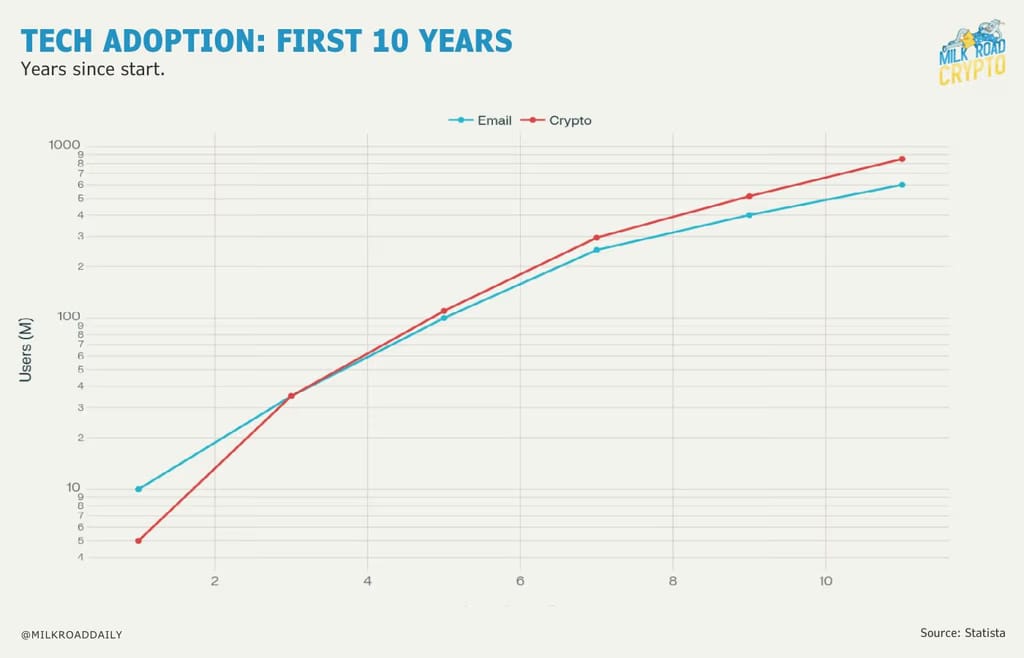

Crypto vs. Email Adoption

When you line up Year 1 for email (1992) against Year 1 for crypto wallets (2016), the curves tell a clear story: crypto is spreading faster than email. At the same stage in its growth, the number of crypto wallets has already surpassed the number of email addresses. Translation: the next wave of users is arriving faster than most expect, pulling forward timelines for product launches, liquidity, and mainstream access.

🧩 Blockchain 101: What is Proof of Work

If a block is like a page in the record book, then mining is the process of stamping that page so it can never be changed.

In Bitcoin and other Proof of Work systems, miners use powerful computers to solve tough math puzzles. The first to solve it earns the right to stamp the page and add it to the chain. As a reward for doing the work, the miner gets newly created Bitcoin plus any transaction fees.

Think of it like a contest: thousands of people are racing to find the right puzzle piece that makes the page fit. Once one finds it, everyone else can see it fits perfectly, and the page is sealed in forever.

Mining is how new coins enter the system — but more importantly, it’s how the chain stays secure, because no page gets added without real work behind it.

Last Week in 101: Who Keep the Chain Honest?

Next Week in 101: What is Proof of Stake?

Thanks for reading this week.

😍 Enjoyed the newsletter? Send it to a friend!

📥 Want to weigh in? Reply to this email with your questions, comments or hot takes. It may be featured next time.

See you next week,

Don’t speculate, validate.

- Validator Digital

Disclaimer: Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment advisor and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This newsletter is for general educational purposes only, is not individualized, and as such should not be construed as investment advice.