📣 Message from Us

Welcome back. 👋 Each week we cut through the noise and explain what’s driving crypto. This week was full of ups and lots of downs in the Crypto market following the rate cut announcement along with lots of ETF actions.

- Validator Digital

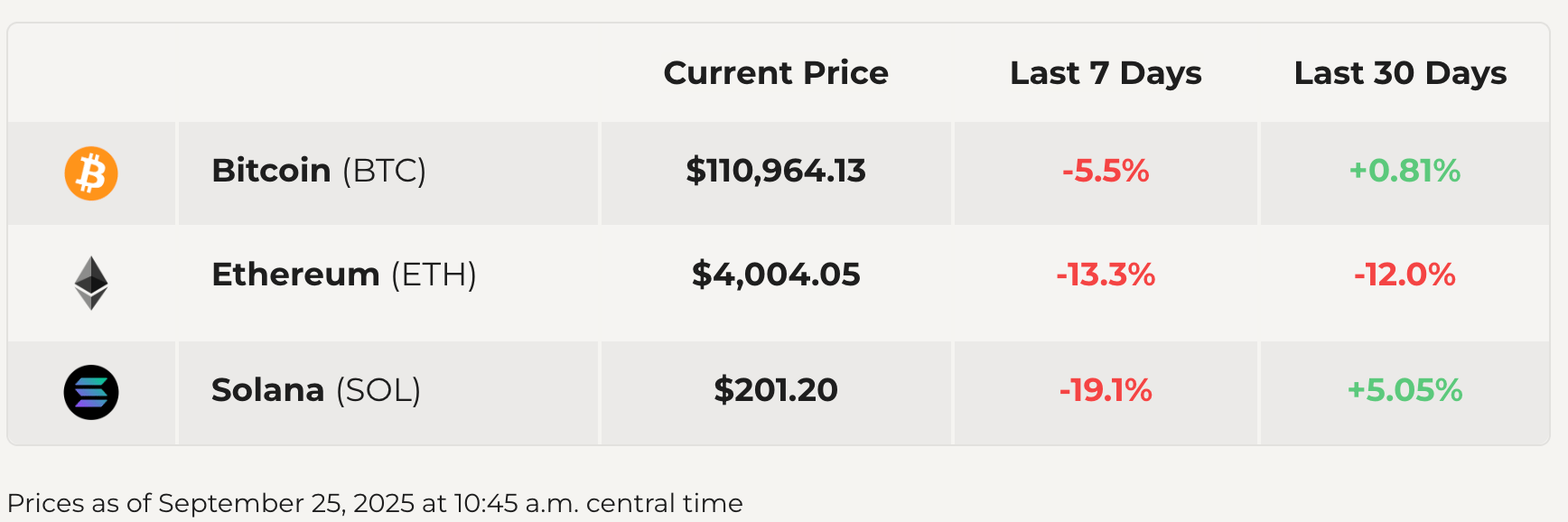

📈 This Week in Markets

The markets went up briefly following the rate cut announcements. But this was followed by one of the biggest sell offs of the year. More on that in our main story.

🔦 Crypto Market Drops Across the Board: What Happened and What’s Next

Crypto sold off hard on Sunday and Monday, with more than $1.5–$1.7B in leveraged longs liquidated. Bitcoin briefly tagged the $111K area before stabilizing, while Ethereum and many large caps fell more on a percentage basis. This was the biggest washout in derivatives since late March. Derivatives are contracts that track the price of crypto rather than the coins themselves, and because they are often traded with borrowed money, they can turn small price moves into large cascades when bets go wrong. Then 4 days later, the market had another, although smaller, crash similar to the one on Sunday. Episodes like this are common in Crypto, so lets explain what happened below.

What set this up.

Conditions were fragile before this week’s two major moves. Leverage had built through the summer rally, leaving many traders long and sensitive to a pullback. ETF flows had turned choppy in the prior week rather than providing steady support, and macro signals weren’t helpful after the Sept 17 Fed rate cut was followed by cautious messaging that kept investors focused on inflation risk rather than a quick easing cycle. That mix of heavy longs, softer flow support, and a more guarded Fed left the market exposed.

How the cascade works.

A leveraged long is a borrowed bet on higher prices. Derivatives are contracts that track crypto prices; leverage is the borrowing layered on top. People use leverage because when the market goes their way, gains are amplified. The flip side is automatic selling when prices fall. As collateral shrinks, exchanges close positions to get repaid, which pushes prices lower and forces more liquidations. On the 21st, that loop ran through futures first and then bled into spot, overwhelming normal dip buying. Then, on the 25th, since there were less leveraged positions opened, a smaller version of this cascade happened.

Who got hit the hardest.

Losses were uneven. Bitcoin fell ~5% at the lows near $111K, while Ethereum dropped closer to ~13% near $4.0k. Among majors, Solana was down ~18% and XRP slid ~9% over the same stretch. Meme coins such as Dogecoin (~18%) and Pepe (~18%) also fell sharply. Their declines weren’t always the largest, but Memes were first in line to sell because they are pure speculation with no real utility or cash-flow value. In stress, traders raise cash by dumping the least useful assets first, so Memes take outsized pressure even when a few large caps show bigger percentage moves.

What happened since.

At the time of this writing, it is unclear what the short term price of the market will do. After the first major cascade, Bitcoin had recovered some of its losses, signaling the typical first-stage stabilization in which BTC finds footing before strength rotates into the rest of the market. So watch the price of BTC to understand the major trends in the market. Similar situations are common in the crypto world, particularly following long stretches of rising leverage They tend to reset positioning rather than rewrite the long-term thesis.

Image generated by Gemini

⏩ Quick Hits + 🔥 Hot Takes

PayPal Opens the Rails to Bitcoin and Ethereum

PayPal just announced that U.S. users will soon be able to send BTC, ETH, and PYUSD through its new PayPal Links across PayPal, Venmo, and compatible wallets. The move folds crypto into everyday transfers, stripping away friction and potentially pulling in millions of new users. As this rolls out (“coming soon”), it puts BTC/ETH on mainstream rails millions already trust—setting the stage for broader participation and real payment trials.DC Turns Up the Heat on a U.S. Bitcoin Reserve

Lawmakers and crypto execs met in D.C. to push a Strategic Bitcoin Reserve with proposals floating to acquire up to 1M BTC over five years and formalize the program launched by March’s White House order. If this advances, it shifts policy risk and could add a structural buyer to the market, meaning clearer rules and steadier demand on the horizon.Wall Street Gets Its First Multi-Crypto ETF

Grayscale’s GDLC is now trading as a multi-crypto ETF on NYSE Arca, tracking the CoinDesk 5 Index (BTC, ETH, XRP, SOL, ADA). Eagle-eyed investors in Validator Digital Asset Fund will notice this is the benchmark the fund is measured against. Listing on NYSE Arca, the NYSE’s all-electronic venue that dominates U.S. ETF listings, drops it straight into the deepest ETF liquidity and standard brokerage access, giving investors a simple way to gain broad large-cap crypto exposure in a single trade.ETF Launches Step Beyond BTC/ETH

Last week’s ETF action centered on new spot funds for XRP and Dogecoin, expanding U.S. access beyond the big two. On day one, the pair logged ~$54–55M in combined volume, led by XRPR at ~$37.7M, the strongest U.S. ETF debut of 2025. It’s a small but clear signal that ETF demand is widening past Bitcoin and Ethereum.SEC Clears a Faster Path for Spot Crypto ETFs

The SEC approved generic listing standards that let NYSE, Nasdaq, and Cboe list qualifying spot crypto ETFs on a preset ~75-day timetable. That compresses review cycles that often stretched six to nine months, opening the door to funds beyond BTC/ETH and pulling more exposure into standard brokerage accounts—more choice, tighter spreads, real competition. It’s another step that continues to show crypto’s adoption in mainstream markets.

Image created by Gemini

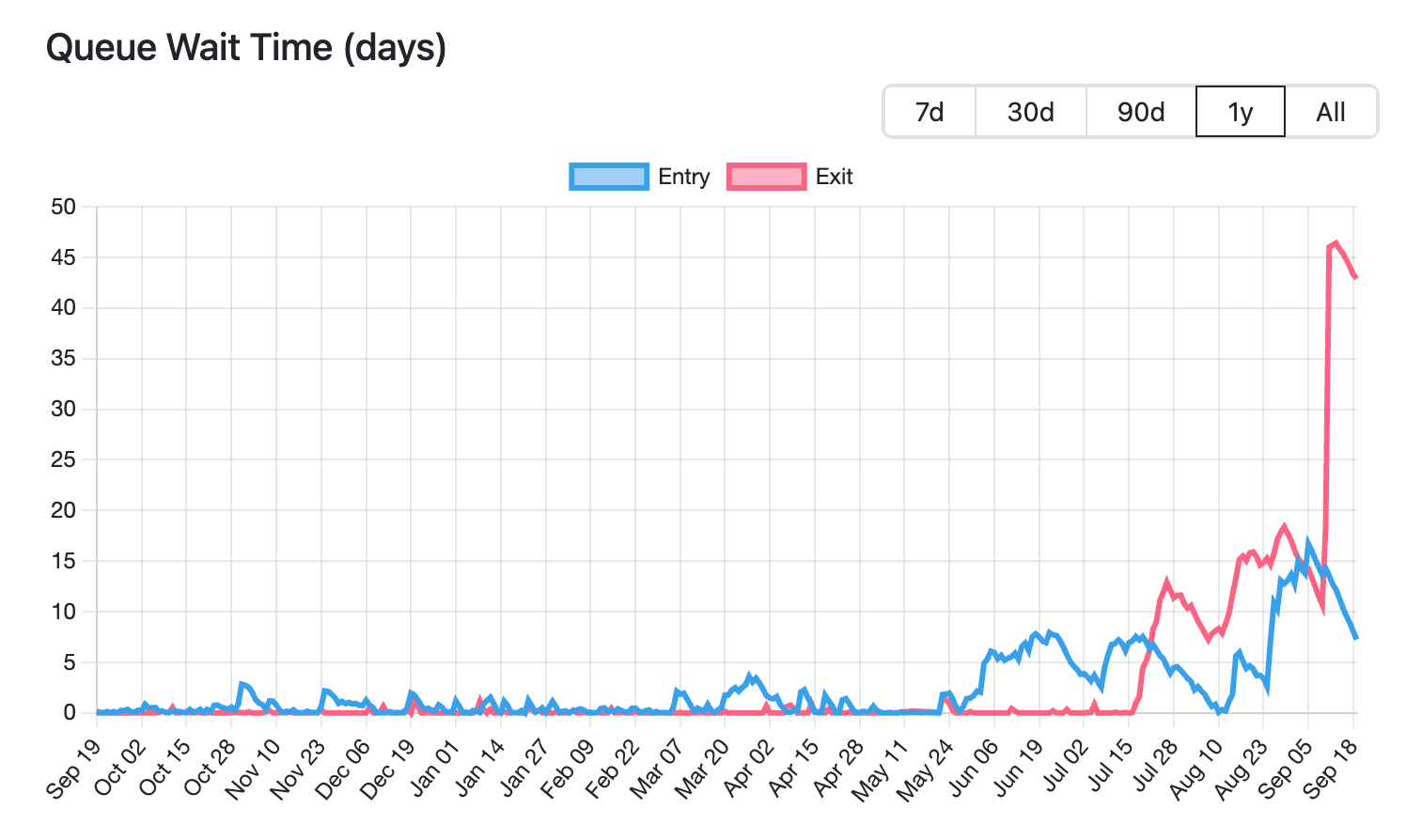

📈 Chart of the Week

Ethereum’s Staking Line Is at Record High

Roughly 2.6–2.7M ETH is in the unstaking queue, about six weeks of wait time, after provider Kiln began an “orderly” exit of all validators following the SwissBorg incident. Think of it like a busy bank lobby: the system’s fine; withdrawals just take longer and may add short-term price noise. It’s not a red flag, and, absent new shocks, the line should ease over the next few weeks as this one-off wave clears through Ethereum’s built-in churn limits.

Blockchain 101: What Is a Staking Queue?

On Ethereum, people who stake their ETH to help run the network can later ask to unstake and get their coins back. But the protocol intentionally caps how many validators can join or leave in each time window to keep the network stable and prevent sudden swings, so requests line up in a staking queue (both entry and exit). Think of it like a theater letting people in or out at a steady pace: when lots show up at once, the line grows, sometimes from hours to weeks, without the doors ever slamming shut.

🧩 Blockchain 101: Who Keeps the Chain Honest?

A record book only works if people trust what’s inside — that money really moved, that a contract was signed, that a ticket was issued, or that a piece of digital property changed hands.

On the blockchain, there isn’t one guard watching the book. Instead, thousands of participants around the world check every new page of transactions.

If most agree the page follows the rules, no double-spending, no fake entries, etc., it gets locked in. If someone tries to slip in a false page, it’s rejected because it doesn’t match the others.

These participants are called miners (in Proof of Work systems like Bitcoin) or validators (in Proof of Stake systems like Ethereum). The honesty comes from the crowd, not from any single authority — and that constant checking is what keeps the blockchain secure.

Last Week in 101: What is a Chain?

Next Week in 101: What is Proof of Work?

Thanks for reading this week.

😍 Enjoyed the newsletter? Send it to a friend!

📥 Want to weigh in? Reply to this email with your questions, comments or hot takes. It may be featured next time.

See you next week,

Don’t speculate, validate.

- Validator Digital

Disclaimer: Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment advisor and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This newsletter is for general educational purposes only, is not individualized, and as such should not be construed as investment advice.