📣 Message from Us

Welcome back. 👋 Each week we cut through the noise and explain what’s driving crypto. This week, crypto experienced one of its worst days in recent memory while action continues in Washington.

- Validator Digital

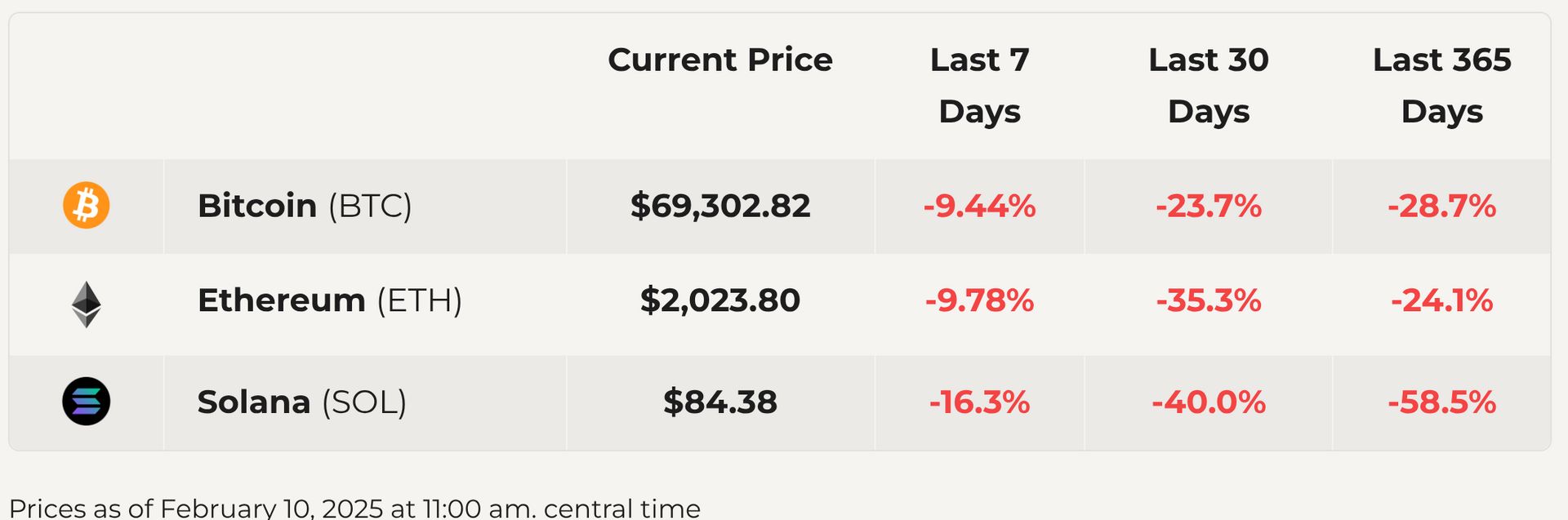

📈 This Week in Markets

Markets sold off hard this week. Our main story breaks down what happened and where we may be headed next.

🔦 Is this the Bottom?

What Happened

Crypto saw a sharp, disorderly selloff. Bitcoin briefly traded into the low $60,000s after falling more than 30% in just nine days, before rebounding to current levels. From the October 2025 all-time high, Bitcoin remains down roughly 50%. Much of the damage was driven by forced liquidations rather than deliberate selling, as leverage unwound and positions were automatically closed. Over $2.6B in leveraged positions were liquidated, marking the 7th-largest liquidation day on record.

Why is it Down?

The selloff stems from several overlapping forces: long-term holders selling early in anticipation of a typical “Bitcoin Four year Cycle,” attention rotating to AI and metals, the major October 10th leverage liquidation, renewed Fed hawkishness fears, lingering quantum computing concerns, and a broader macro risk-off move.

Is Crypto Winter Back?

The “Crypto Winter” narrative has returned to mainstream coverage, driven by the size and speed of the drawdown and the visible hit to sentiment and flows. That pessimism is showing up in the data: the Crypto Fear and Greed Index recently fell to 5 on a scale of 1-to-100, the lowest readings on record. Commentary now spans a wide range, from calls of a “full-blown crypto winter” to equally confident predictions of a rapid V-shaped recovery, underscoring just how polarized expectations have become.

Reasons We Might Be Near a Bottom

Price found support exactly where long-term valuation models converge. Bitcoin held near $60,000, aligning with the estimated miner break-even cost, the realized price on-chain, and the 200-week moving average, a level that has historically defined bear-market floors.

Reasons There’s More Room to Drop

History argues for caution. Previous Bitcoin drawdowns were deeper than today’s roughly 54% decline, falling 86% in 2014, 84% in 2018, and 77% in 2022. Past crypto downturns have also tended to last 12 to 13 months, suggesting this one may not be finished yet.

That said, Crypto is a more mature asset class than in prior cycles, making an extreme drawdown less likely, but further downside remains possible.

How does this End?

Most crypto bear markets end with time and exhaustion, not a single catalyst. Leverage clears, volatility fades, and sellers eventually run out.

There are potential upside shocks to watch for, including progress on the CLARITY Act, a return to risk-on markets, advances on quantum mitigation, rising rate-cut expectations, or renewed AI-driven crypto adoption. Any could help, but none are required.

In the meantime, strategy matters. A traditional HODL approach accepts volatility and drawdowns as the cost of long-term exposure, often requiring investors to sit through significant unrealized losses. Actively managed crypto strategies take a different approach, using risk management, hedging, and selective shorts to reduce downside and preserve capital during disorderly markets, while still maintaining exposure for when conditions improve.

Image Generated by Gemini

⏩ What Else You Need to Know

Tennessee Joins the State-Level Bitcoin Treasury Push

Tennessee advanced legislation that would allow the state to hold Bitcoin as part of its treasury, joining a broader trend: ~26 U.S. states have now introduced Bitcoin reserve or treasury-related bills, with dozens of proposals active nationwide. As federal crypto regulation progresses, expect more states to formalize their own approaches as wellWhite House Stablecoin Yield Talks Resume

Last week, senior White House officials hosted a closed-door meeting with crypto and banking policy representatives focused on stablecoin yield rules and how those fit into the stalled Clarity Act. Participants described the session as productive but unresolved. No deal was struck on yield provisions, which remain the central sticking point.A second meeting is scheduled for today (Feb. 10) to continue negotiations with both crypto and bank representatives, with the goal of completing negotiations and regaining momentum on the Clarity Act.

Trump–UAE Crypto Deal Draws Washington Scrutiny

Days before Donald Trump’s inauguration, a UAE-backed entity secretly agreed to purchase 49% of World Liberty Financial for $500M, routing $187M directly to Trump family entities, according to the Wall Street Journal. The deal has intensified Democratic concerns over conflicts of interest, foreign influence, and corruption, complicating bipartisan progress on crypto legislation like the Clarity Act.Fidelity Accelerates Its Crypto Push

Fidelity has made Bitcoin and Ethereum trading available to retail customers in all 50 U.S. states, marking a notable shift in both tone and pace. After years of cautious experimentation, Fidelity is now moving quickly, scaling distribution, integrating crypto into core brokerage workflows, and treating digital assets less like a side project and more like a standard allocation option.

📺 Video of the Week

Crypto’s First Superbowl Ad Since 2022

In case you missed it, crypto returned to the Super Bowl for the first time since 2022 with a new Coinbase ad. This year’s spot ditched the QR code gimmick for a simple singalong to “Everybody (Backstreet’s Back)”, closing with a clear message: crypto is for everybody.

🧩 Blockchain 201: What is a DEX?

A DEX, or Decentralized Exchange, is a way to trade crypto directly on the blockchain instead of through a centralized company. There is no account to open, no custody of your funds, and no middleman matching trades behind the scenes.

On a traditional exchange, you deposit your money and trust the platform to hold it, process trades, and let you withdraw later. On a DEX, trades happen directly from your wallet using smart contracts. You stay in control of your assets the entire time.

DEXs like Uniswap, Curve, and PancakeSwap use on chain liquidity pools and transparent rules to set prices and execute trades automatically. Anyone can see how trades work, fees are predictable, and the system runs continuously without relying on a single company.

DEXs make trading more open, permissionless, and resilient than centralized exchanges. And for a DEX to function smoothly, it needs enough assets available to trade, which brings us to liquidity, the next part of the story.

Next Week: What is a Liquidity?

Last Week: What is DeFi?

Thanks for reading this week.

😍 Enjoyed the newsletter? Send it to a friend!

📥 Want to weigh in? Reply to this email with your questions, comments or hot takes. It may be featured next time.

See you next week,

Don’t speculate, validate.

- Validator Digital

Disclaimer: Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment advisor and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This newsletter is for general educational purposes only, is not individualized, and as such should not be construed as investment advice.