📣 Message from Us

Welcome back. 👋 Each week we cut through the noise and explain what’s driving crypto. This week crypto makes its way from network upgrades to policy shifts…and even onto the burger counter.

- Validator Digital

📈 This Week in Markets

Crypto prices bounced around all week, with sharp moves up and down but no clear direction sticking. Bitcoin ETFs saw net outflows, and that uncertainty showed up in price action as rallies faded quickly. The market stayed active, but conviction remained hard to find. For now, crypto remains in a waiting and sideways phase rather than a breakout.

🔦 Clarity Act Update

What Happened

The CLARITY Act was expected to move forward around January 15, and while progress stalled in parts of the Senate, the Agriculture Committee did continue advancing its portion of the bill, signaling ongoing momentum on the CFTC side.

Why It Got Held Up

The main roadblock has been stablecoin yield rules. The latest draft would restrict or ban yield on stablecoins, limiting crypto platforms’ ability to offer interest-like returns that compete with bank deposits. Banks have pushed for this language, warning that high digital-dollar yields could pull away trillions in deposits, estimates run as high as $6 trillion, out of the traditional banking system.

That provision prompted Coinbase to withdraw its support for the bill, saying the restriction would undermine innovation and effectively protect banks’ revenue models at the expense of open finance.

What’s Next

Senate committees are now revising disputed language, with the Agriculture Committee moving ahead while banking and securities issues are renegotiated. Updated text is expected later this winter, with possible markups and a Senate vote later this spring if consensus holds.

Why It Matters

The delay doesn’t signal defeat — it reflects active negotiation. The CLARITY Act could still become the first comprehensive federal crypto statute, but its timeline has clearly shifted as lawmakers refine the most contentious provisions.

Image Generated by Gemini

⏩ What Else You Need to Know

South Korea Ends 9-Year Crypto Ban

South Korea’s Financial Services Commission has officially lifted a nine-year ban on corporate crypto investments, allowing listed companies and professional investors to allocate up to 5% of their equity capital into the top 20 cryptocurrencies. This marks a major shift in Asia’s regulatory landscape and could unlock significant institutional capital into digital assets.Bermuda Plans a Fully On Chain Economy

Bermuda’s government has unveiled an ambitious plan to transform its entire economy onto blockchain infrastructure, partnering with Coinbase and Circle to integrate stablecoin payments, tokenization, and digital finance tools across government, banks, businesses, and consumers. The goal is simple: lower transaction costs, faster settlement, and a more efficient financial system built directly on digital infrastructure.CFTC Unveils “Future-Proof” Initiative to Modernize Crypto Rules

The U.S. Commodity Futures Trading Commission announced a new “Future Proof Initiative” to modernize outdated market rules and better account for crypto and blockchain based financial products. The goal is to create clearer, more durable regulations that support innovation while maintaining market integrity.Chainlink Launches 24/5 U.S. Stock Price Oracles (🧩201 Alert)

Chainlink has officially launched 24/5 U.S. equities and ETF price streams that deliver continuous, cryptographically verified stock market data on more than 40 blockchains. By filling in pre-market, after-hours, and overnight pricing gaps, these streams lower friction for tokenized equities and equity derivative products in DeFi and make real-world asset markets more reliable for builders and traders.

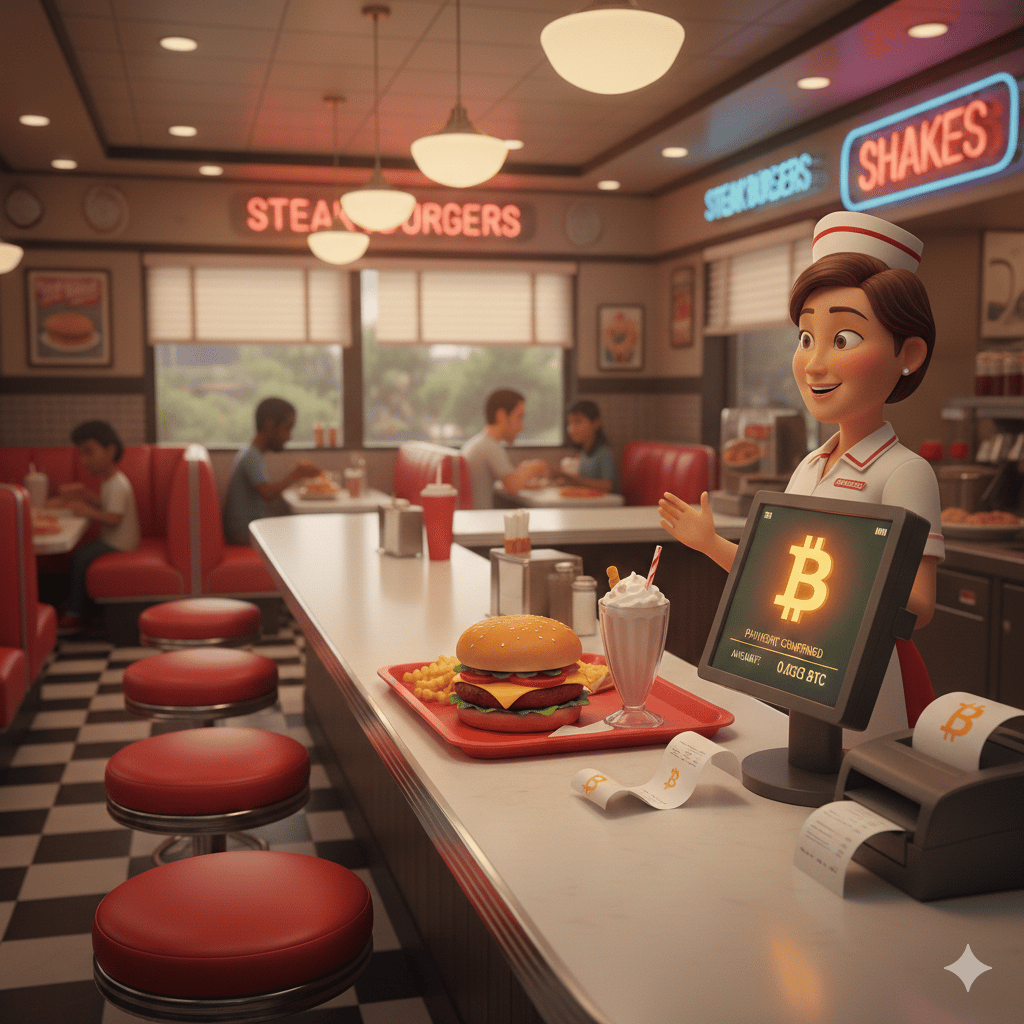

Steak ’n Shake Adds $10M of Bitcoin to Its Treasury

Steak ’n Shake revealed it purchased $10 million in Bitcoin after months of accepting BTC payments, citing lower fees and positive customer response. The chain now routes Bitcoin payments directly into a corporate reserve, showing how real-world businesses are beginning to treat crypto as operating infrastructure, not just an investment.

Image Generated by Gemini

📊 Chart of the Week

Ethereum Overtakes Bitcoin in New Address Growth

Ethereum is now onboarding more new addresses than Bitcoin, meaning more first-time participants are entering the ETH ecosystem. While BTC’s growth has stayed relatively flat, ETH’s acceleration reflects the impact of network upgrades and expanding use cases. The signal is clear: Ethereum’s network effects are compounding faster, making it the dominant player for new user adoption.

🧩 Blockchain 201: What is an Oracle?

Blockchains are great at following rules, but they can’t see the outside world on their own. An oracle is the system that brings real-world information onto the blockchain so smart contracts and DAOs can act on it.

Think of an oracle like a trusted data feed. It reports information blockchains can’t access themselves — things like asset prices, market data, or the outcome of an event — and smart contracts use that data to decide what happens next.

For example, DeFi apps use oracles to know the current price of ETH or Bitcoin, lending platforms use them to decide when loans are safe or risky, and DAOs use them to manage treasuries and make financial decisions. Without oracles, none of these systems could function safely.

Well-known oracle networks like Chainlink and Pyth specialize in delivering this data reliably and securely. Oracles connect blockchains to the real world — and once that connection exists, fully on-chain financial systems become possible. That’s where DeFi comes in, next.

Next Week: What is DeFi?

Last Week: What is a DAO?

Thanks for reading this week.

😍 Enjoyed the newsletter? Send it to a friend!

📥 Want to weigh in? Reply to this email with your questions, comments or hot takes. It may be featured next time.

See you next week,

Don’t speculate, validate.

- Validator Digital

Disclaimer: Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment advisor and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This newsletter is for general educational purposes only, is not individualized, and as such should not be construed as investment advice.