📈 This Week in Markets

📊 Chart of the Week

Aave is the top lending and borrowing platform, with $39.5B in assets. If it were a bank, it would be #53, just below Raymond James. This graph shows that the adoption of AAVE has been consistent as markets have grown. AAVE is set to be a winner as stablecoin adoption grows. As a user of Aave, its no surprise given the depth of liquidity, competitive rates, and ease of use.

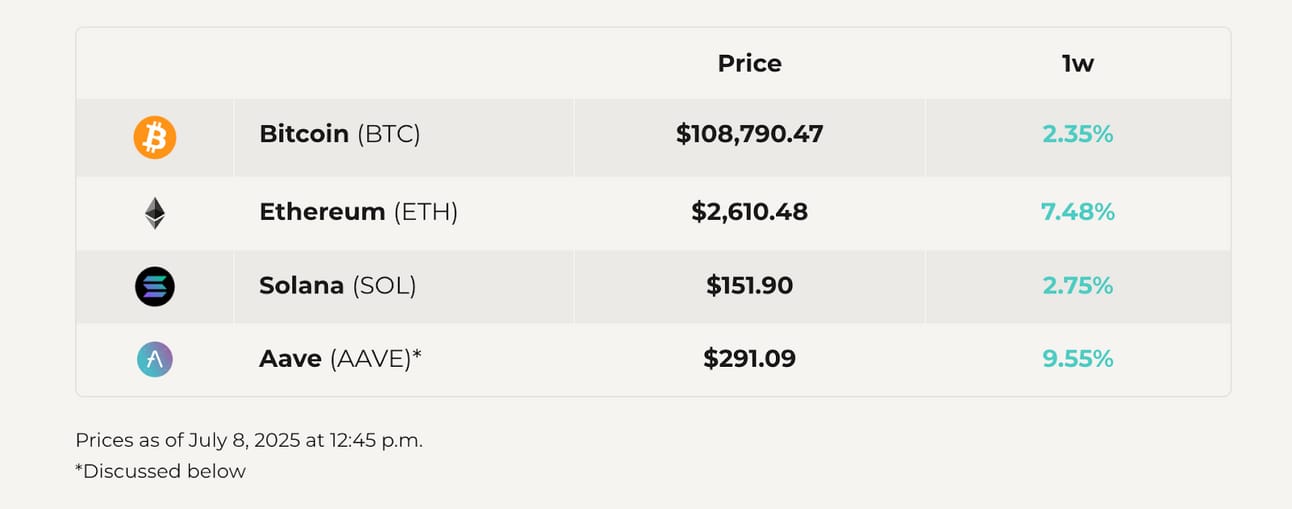

Aave token holders receive a portion of the fees earned from each interest payment. The AAVE token is up 9.5% this week and 285% YTD.

Disclosure: The Validator Digital Asset Fund, LP is an investor in AAVE.

Post of the Week

President's Council of Advisers on Digital Assets to release its first report July 22. Executive Director Bo Hines previews their thinking in this video.

🔑 Key Takeaways:

It’s clear that a Strategic Bitcoin Reserve is a high priority for this president. I would not be surprised by a significant announcement on July 22. Especially given the (perhaps comical?) ways that the government can buy Bitcoin in a “budget neutral” manner.

It’s notable that the GENIUS Act will be the first bipartisan banking legislation passed in almost a decade.

The crypto market currently sits at $3.3T. Growth to $15T would represent an almost 5x increase.

House GOP Declares ‘Crypto Week’

Republican lawmakers will use the week of July 14 to fast-track key crypto legislation — including bills that could reshape how digital assets are regulated in the U.S.

✅ What happened: The House will push three major crypto bills during “Crypto Week”:

The CLARITY Act: gives the CFTC more authority over digital assets and limits SEC power.

The GENIUS Act: sets up guardrails for stablecoins, and has been approved by the Senate.

The Anti-CBDC Act: prevents the Fed from issuing a “digital dollar” over fears of surveillance and financial control.

Franklin Templeton Doubles Down on Tokenization

📰 What happened?

Franklin Templeton’s Head of Innovation, Sandy Kaul, laid out the firm’s ambitious plans to bring trillions in traditional assets onto blockchains. The $1.6 trillion asset manager is already running a tokenized U.S. Treasury fund on public blockchains and now wants to expand to equities, money markets, and eventually private assets.

💡 Why it matters?

Tokenization — converting traditional assets into blockchain-based tokens — promises faster settlements, lower costs, and broader access. If legacy giants like Franklin Templeton succeed, it could shift finance from paper-based infrastructure to programmable, interoperable systems.

🏆 Winners?

Public blockchains which host Franklin’s tokenised funds. As discussed in last week’s newsletter, there rate of real world assets on chain is accelerating.

DeFi primitives like DEXs and lending protocols (like Aave), which could tap into tokenised versions of RWAs (real-world assets).

Retail and global investors, who may gain fractional, 24/7 access to assets historically locked behind institutional walls.

💥 Losers?

Legacy custodians and intermediaries, who risk disintermediation as smart contracts handle asset issuance and transfer.

Slow-moving asset managers, who could lose relevance if they don’t adapt to blockchain rails.

🔥 Hot Take

The article ends with a hot take from Kaul. The entire tokenisation market – stocks, funds, private credit, and government debt – is worth $24 billion. The global public stock market alone was valued at nearly $115 trillion in 2023, according to a World Economic Forum report.

“We’re waiting for the regulations to clarify how we can list our regulated products on crypto exchanges,” she said, adding that after that, it’s simply a matter of engaging market makers to drum up liquidity around these products. [After that,] that’s when you’ll start to see wholesale tokenization.”

📥 Want to weigh in? Reply to this email with your comments or hot takes. It may be featured next week.

Don’t speculate, validate.

- Validator Digital