📈 This Week in Markets

🔦 Main Feature: Hyperliquid Crushes Robinhood in Monthly Volume—Again

For the third month in a row, decentralized exchange Hyperliquid outperformed Robinhood in trading volume—by a substantial margin. In July, Hyperliquid pulled in $330.8 billion in combined spot and perpetual trading volume, a 39% edge over Robinhood’s $237.8 billion, marking the widest gap yet in their rivalry.

This trend has held steadily:

May: Hyperliquid – $256B vs. Robinhood – $192B

June: Hyperliquid – $231B vs. Robinhood – $193B

July: Hyperliquid – $330B vs. Robinhood – $237B

Crucially, Hyperliquid achieved this dominance with a user base of only ~520,000 accounts, compared to Robinhood’s 26.5 million funded accounts—highlighting its outsized trading efficiency and appeal in the derivatives space.

While Robinhood remains dominant in equities and options, its crypto volumes have slid in 2025 as traders migrate to specialized platforms. Hyperliquid’s edge comes from its deep liquidity in perpetual futures (over 70% market share) and an on-chain, high-speed trading engine that delivers transparency and near-zero latency. That combination of speed, transparency, and focus has turned Hyperliquid from a DeFi upstart into a serious competitor for one of fintech’s most recognized names.

⏩ Quick Hits + 🔥 Hot Takes

Top Down: Powell’s Cut Fuels Risk Rally

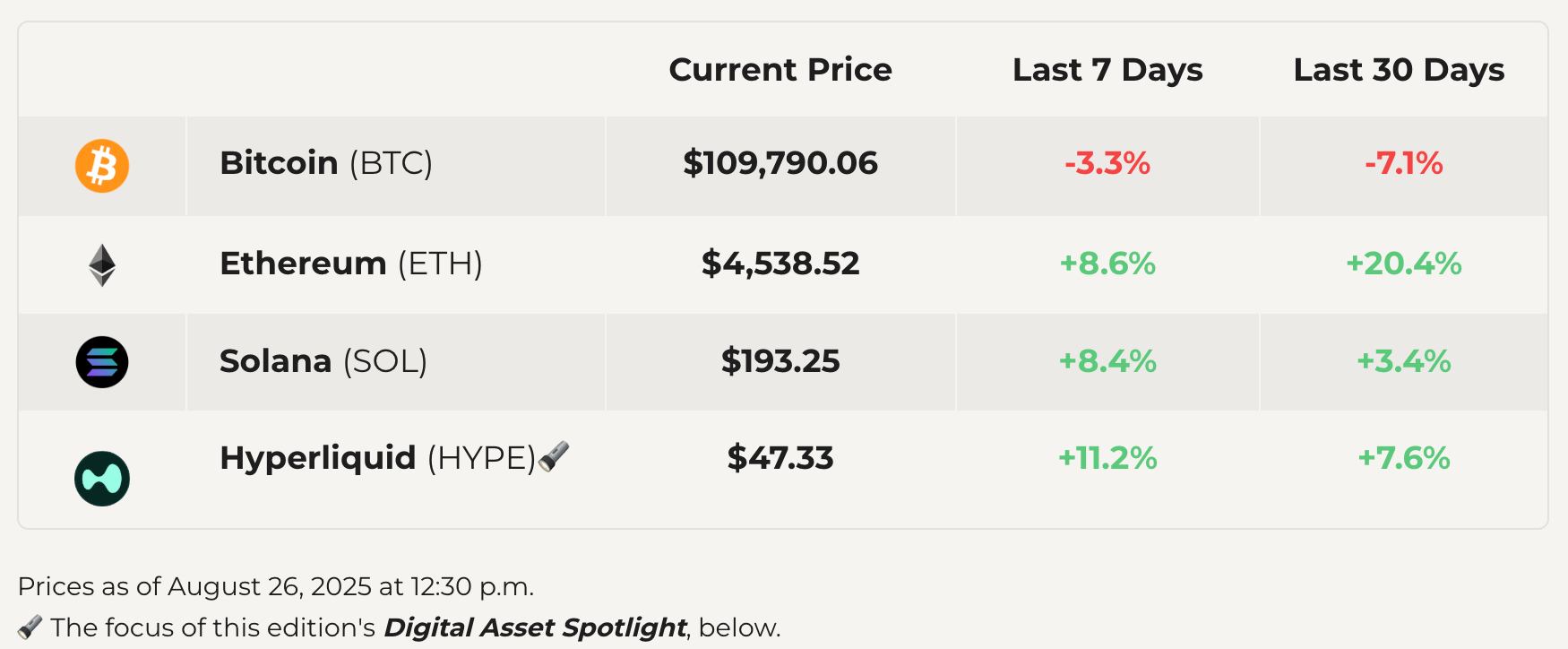

Jerome Powell’s signal of September rate cuts at Jackson Hole sparked a rally in risk assets. Ethereum surged 14% to $4,800 while Bitcoin rose 4%, as investors piled into DeFi and U.S. ETFs that now hold 7–10% of all existing BTC.

Picture Generated by ChatGPT

Bottom Up: Bitcoin Finds Real-World Utility

This week, Vexl highlighted how people are paying for everyday goods and services—like honey and haircuts—directly with Bitcoin through its privacy-first peer-to-peer app. By cutting out centralized exchanges, Vexl shows how grassroots adoption is building sticky demand, giving investors a window into Bitcoin’s growing real-world use.

Perspective Check: Is Bitcoin actually Underperforming?

Bitcoin is up over 600% this cycle with less volatility than past runs, but its strength looks less impressive when measured against tech stocks, gold, or global liquidity. Much of the rally may reflect fiat debasement rather than true outperformance—leaving investors watching whether BTC can push to new highs in real purchasing power terms.

Hype Check: YZY’s $3B Launch Crashes Amid Insider Concerns

Kanye West’s YZY token rocketed to a $3 billion valuation within 40 minutes before collapsing 65%-70%. With insiders allegedly controlling 94% of supply and linked wallets profiting $12 million, the episode raises fresh questions about transparency in celebrity-backed tokens.

Policy Check: Wyoming’s Frontier Token Sets State Stablecoin Standard

Wyoming launched the first state-issued stablecoin, Frontier backed by dollars and Treasuries and designed to run across seven blockchains. Unlike USDT or USDC, reserve interest will fund education and public programs—offering a test case for states exploring stablecoins while addressing CBDC fears.

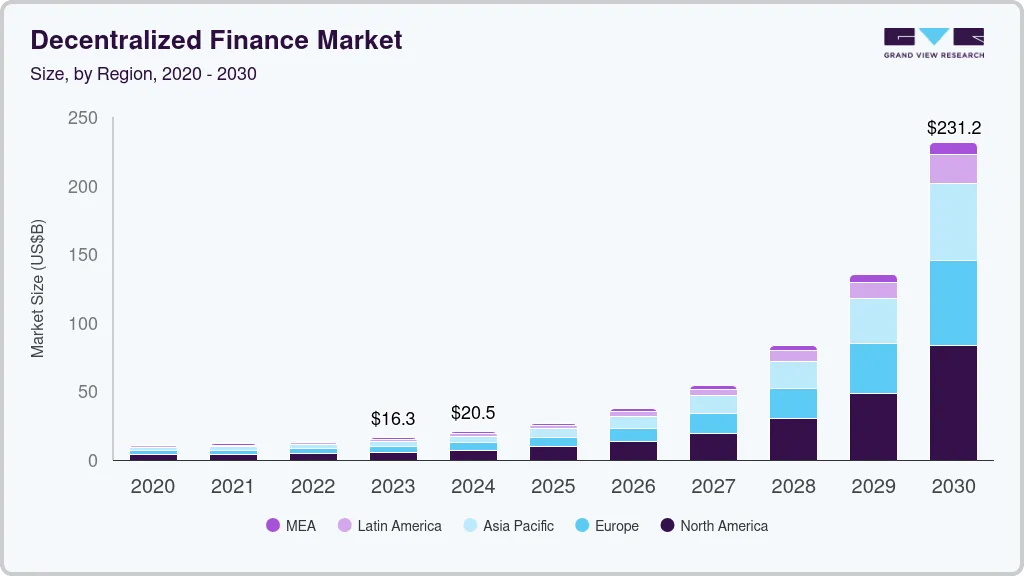

📊 Graph of the Week

The DeFi market is set to surge from $20.5B in 2024 to $231B by 2030 (53.7% CAGR). North America leads today, but Asia Pacific is catching up fast as DeFi cuts out banks, lowers fees, and opens access globally. Growth is being fueled not just by finance, but also by everyday payments, lending, investing, insurance, gaming, and even betting on world events—showing how DeFi is moving from niche to mainstream.

📥 Want to weigh in? Reply to this email with your comments or hot takes. It may be featured next time.

Want to learn more? Reach out to [email protected]

Thanks for reading this week.

Don’t speculate, validate.

- Validator Digital

Disclaimer: Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment advisor and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This newsletter is for general educational purposes only, is not individualized, and as such should not be construed as investment advice.