📣 Message from Us

Welcome back. 👋 Each week we cut through the noise and explain what’s driving crypto. The common thread this week is movement: banks testing new tools, platforms adding stablecoin payouts, and regulators preparing for clearer rules.

- Validator Digital

📈 This Week in Markets

Crypto spent the week, like the past few weeks, chopping sideways. Bitcoin remained stuck between $85K and $93K, repeatedly breaking out of that range but failing to hold. These quick reversals show active buyers and sellers, but little conviction from either side.

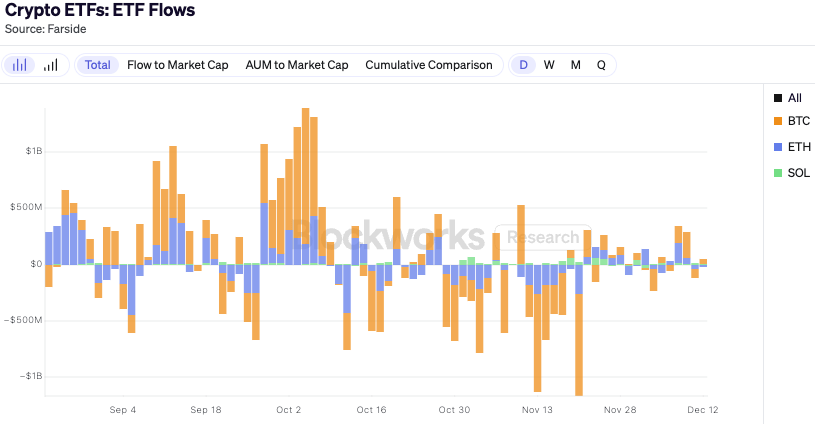

Even so, the market appears to be forming a short term bottom. Dips are getting bought more consistently, and we have now seen three straight weeks of neutral to positive ETF inflows, a constructive signal for sentiment.

Zoomed out, the market is stabilizing. Zoomed in, volatility remains high. Until a clear catalyst emerges or the new year begins, crypto is likely to stay in this range.

🔦 The CFTC Opens a Path for Crypto Collateral

What Happened

The Commodity Futures Trading Commission, or CFTC, launched a pilot program this week that lets regulated derivatives exchanges use Bitcoin, Ethereum, and a stablecoin (USDC) as collateral.

What is a Derivatives Market

Derivatives markets require every trader to post collateral before they place a trade. This collateral protects the exchange if prices move and a trader cannot cover their losses. If that happens, the exchange takes the collateral to settle the trader’s obligations.

Today, that collateral must be cash or short-term government debt. A trader who holds crypto has to sell it, move dollars through a bank, and only then can they post the funds. The CFTC pilot lets approved firms use Bitcoin, Ethereum, or USDC directly instead of going through those steps.

Why it Matters for Banks:

Banks handle the cash movements that back these markets. Using digital assets as collateral reduces the dependence on slow transfers and gives banks a clearer path to support faster settlement and custody services.

Why it Matters for traders:

Traders can post the assets they already hold and meet collateral calls faster. That lowers funding costs, reduces forced liquidations, and lets firms manage risk without waiting on banking hours.

Future Impact

This market move tens of trillions of dollars in trades each year and hold hundreds of billions in collateral to keep the system safe. If the pilot proves workable, digital assets could become part of that collateral base. Margin calls could settle in minutes. Banks could offer faster settlement and custody. Traders could manage crypto and traditional positions from the same pool of assets.

The shift is simple: digital assets begin to function like cash inside a major financial market.

Image Generated by Gemini

⏩ What Else You Need to Know

USDCx adds privacy for banks using digital dollars

Circle and Aleo are developing USDCx, a version of the USDC stablecoin that keeps payment details private on public networks. A major barrier for banks has been the public nature of most blockchain transactions, which does not work for sensitive client activity. USDCx keeps transactions confidential while still allowing regulatory oversight, removing a key obstacle and opening the door to broader use of digital dollars across the banking system.JPMorgan issues short term debt on Solana

JPMorgan arranged a 50 million dollar short term loan for Galaxy Digital and recorded it on the Solana public blockchain, with Coinbase and Franklin Templeton as lenders. The debt was issued and settled in USDC to test whether public networks can support faster financing flows. It is a small step in a $1.3t market, but it shows how routine corporate borrowing could move to public settlement networks.SEC chair signals quick action on crypto in 2026

SEC Chair Paul Atkins said the agency is preparing to move quickly on crypto rules next year rather than wait for Congress. He signaled a shift toward clearer pathways for digital asset firms instead of relying on enforcement alone. This points to a more defined regulatory setup for crypto in 2026.YouTube lets U.S. creators get paid in PayPal’s stablecoin

YouTube now lets eligible U.S. content creators receive earnings in PayPal’s PYUSD stablecoin. The platform supports about 69 million creators and has paid out more than $100 billion in recent years. Accepting PYUSD gives creators another way to hold digital dollars and is faster than waiting on slow bank transfers for the traditional dollar.

Image Generated by Gemini

📊 Chart of the Week

ETF flows flatten out

As the market climbed toward its all-time high, Bitcoin and Ethereum ETFs saw steady net inflows. After the peak, that flipped to mostly outflows as investors pulled back. Over the past three weeks, flows have been largely neutral, with smaller moves in either direction. This suggests selling pressure is easing and the market may be trying to set a base.

🧩 Blockchain 201: What Are Tokens vs. Coins?

If a blockchain is like a city, then its coin is the native currency that keeps that city running — Bitcoin on Bitcoin, ETH on Ethereum, SOL on Solana. It’s built into the network itself and powers everything underneath the surface.

A token is created on top of a blockchain by a smart contract, not by the blockchain’s core code. Tokens are interchangeable within their own system — like arcade tokens or casino chips — because the contract that created them gives each one the same rules and the same value.

Since tokens live inside a blockchain’s ecosystem, they depend on the blockchain’s native coin to function. On Ethereum, every token — whether it acts like money, points, tickets, or access — must use ETH to pay gas fees whenever it moves. As more tokens and apps are built on a chain, the native coin is used more often, which naturally increases its importance and demand.

Tokens can represent almost anything, but most of them are identical to one another. One special kind, however, is not interchangeable at all. Each one is unique — and those are NFTs, the next part of the story.

Next Week: What is an NFT?

Last Week: What is a Smart Contract?

Thanks for reading this week.

😍 Enjoyed the newsletter? Send it to a friend!

📥 Want to weigh in? Reply to this email with your questions, comments or hot takes. It may be featured next time.

See you next week,

Don’t speculate, validate.

- Validator Digital

Disclaimer: Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment advisor and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This newsletter is for general educational purposes only, is not individualized, and as such should not be construed as investment advice.