📈 This Week in Markets

📺 Clip of the Week

New and want to understand Bitcoin & crypto? Do yourself a favor and take 6 minutes to watch this testimony from Peter Van Valkenburgh, Executive Director at Coin Center.

🔑 Key Takeaways:

Why is it revolutionary? “Unlike every other tool for sending money on the internet, it works without the need to trust a middleman.”

Is it perfect? “No. Neither was email when it was invented in 1972. … It will be as significant for freedom, prosperity, and human flourishing as the birth of the internet.”

📈 Chart of the Week

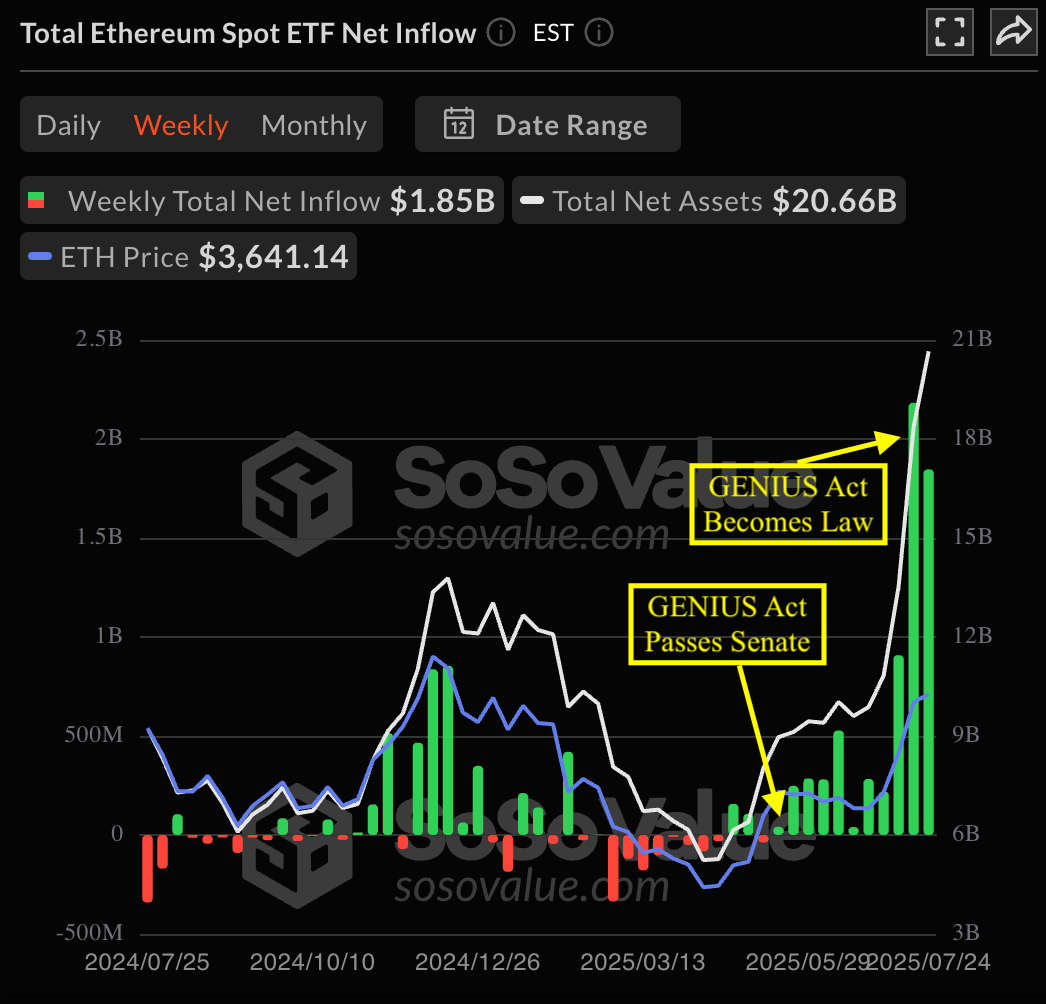

Inflows into Ethereum ETFs have exploded in the last two weeks, surpassing Bitcoin ETF’s inflows. Since President Trump signed the GENIUS Act on July 18, the price of Ethereum has tracked these inflows closely.

Interestingly, Solana’s ETF is also seeing record inflows, but on a much smaller scale. It is underperforming based on relative marketcaps.

⏩ Quick Hits + 🔥 Hot Takes

President’s Working Group: Will release its 180-Day report on July 30. (X Post)

🔥 Expect it to be Bitcoin Friendly: Trump Media and Technology Group, the company founded by President Donald Trump and parent of Truth Social, announced that it has acquired approximately $2 billion in bitcoin and bitcoin-related securities as part of its crypto treasury strategy. (PR Newswire)

Stablecoins: Tether, the issuer of the USDT stablecoin, plans to go live in the US as early as the end of the year. (Bloomberg)

🔥 Competition for Stablecoin marketshare is on. CEO Paolo Ardoino said Tether plans to launch a new dollar-backed stablecoin and focus on institutional payments and interbank settlements. USDT accounts for 61% of the $266 billion market capitalization in stablecoins — you can bet big banks and other institutions will take its offerings seriously.

DeFi: Aave became the first DeFi lending protocol to surpass $50 billion in net deposits, driven by TradFi adoption, multichain growth, and increasing use of stablecoins. (The Block)

🔥 Fees earned by Aave and paid to depositors and AAVE holders now stands at $737M/year. (DefiLlama)

Legislation: Senate Banking Committee Chair Tim Scott (R-SC), Senate Banking Subcommittee on Digital Assets Chair Cynthia Lummis (R-WY), and Senators Bill Hagerty (R-TN) and Bernie Moreno (R-OH) released an initial discussion draft of digital asset market structure legislation. (Discussion Draft)

🤝 Bipartisan Support: This draft for the Senate builds on the bipartisan Digital Asset Market Clarity Act, which passed the house last week 294-134.

🔥 Enter the Lobbysts: At least 27 crypto companies or advocates filed their first-ever lobbying disclosures this year. Now crypto has a receptive ear on both sides of the aisle in Washington. That friendliness is due in large part to the success of crypto lobbyists during the 2024 election cycle. This participation is needed and couldn’t be coming at a better time. Getting these bills right is a complicated task that involves industry involvement. (The Hill)

🎯 Staying on Target

Blockchain initiatives, and Ethereum specifically, are gaining mainstream adoption faster than anticipated. Here are some data points from the last few weeks to highlight the trend.

GENIUS Act opened the floodgates, and a host of Wall Street announcements followed:

Goldman Sachs and BNY Mellon are launching tokenized money market funds backed by U.S. Treasuries, enabling 24/7 liquidity and portfolio management via smart contracts on Goldman’s Digital Asset Platform and BNY Mellon’s LiquidityDirect, with early adopters including BlackRock, Fidelity, and Goldman itself. (Unchained)

JPMorgan is considering lending against bitcoin and ether through third-party custodians, signaling increased institutional participation as regulatory pressures ease. (Financial Times)

Western Union is building stablecoin on- and off-ramps within its digital wallet and exploring global stablecoin offerings for cross-border payments and value storage. (The Block)

PNC Bank is partnering with Coinbase to give its 12 million customers access to crypto through Coinbase’s Crypto-as-a-Service platform, merging traditional finance with digital assets. (The Block)

Bitcoin Mining Companies are abandoning their business models to become Ethereum staking companies. (Business Insider)

Blackrock’s crypto chief moves to become Co-CEO of Ethereum’s second-biggest treasury company (DL News).

To me, this is big. I have always believed that one of the best leading indicators in crypto is who-works-where-when. When you see highly compensated people jump ship, they tend to do it out of conviction.

“Ethereum is becoming the foundation of global finance…

Stablecoins, tokenized assets, AI agents, are all moving onchain.

And it’s happening on Ethereum. That’s where the future is being built.”

🔦 Digital Asset Spotlight

Under the spotlight this week is Rocketpool (RPL). Rocketpool has seen significant growth after a rough year. Two noteworthy developments are affecting the protocol:

There is additional demand for ETH staking services, which Rocketpool provides.

A redesigned tokenomics proposal is currently being tested, and should be live soon.

Want to learn more? Reach out to [email protected].

📥 Want to weigh in? Reply to this email with your comments or hot takes. It may be featured next time.

Thanks for reading this week. I after publishing weekly for the last two months, I listened to your feedback. Basically: “More links, charts, and videos. Less frequently.” Please keep the feedback coming.

Don’t speculate, validate.

- Validator Digital

Disclaimer: Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment advisor and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This newsletter is for general educational purposes only, is not individualized, and as such should not be construed as investment advice.